The Great Australian Health Heist: Why Your Private Insurance Premium Hike Is Actually a Subsidized Corporate Bailout

The 'pay more, get less' crisis in private health insurance isn't about inflation; it’s about regulatory capture and who is truly bankrolling the system.

Key Takeaways

- •Premiums are rising disproportionately because industry lobbying has created an artificially captive market.

- •The complexity of policy tiers (Bronze/Silver/Gold) is a deliberate tactic to suppress price competition.

- •The ultimate loser is the middle-class consumer, who is forced to pay more for reduced coverage.

- •The system is structurally biased toward subsidizing corporate balance sheets, not patient care.

The Hook: Are You the Product or the Payer?

General Practitioners (GPs) are finally speaking the truth we’ve all suspected: Private health insurance in Australia has become a financial black hole. The refrain, “pay more, get less,” echoes across dinner tables, but this isn't mere inflation. This is the visible symptom of a deeper, structural rot where premium hikes serve not the consumer, but the balance sheets of industry giants. The unspoken truth is that the consumer is not just paying more; they are unknowingly subsidizing a broken market structure.

The current debate centers on escalating premiums juxtaposed against shrinking coverage—a classic squeeze play. But the real action isn't in the hospital waiting rooms; it’s in the back rooms of lobbying firms. We need to analyze private health insurance not as a consumer service, but as a heavily regulated cartel benefiting from regulatory capture.

The 'Why It Matters': Regulatory Capture and the Illusion of Choice

Why are premiums rising so sharply while value declines? It’s simple economics married to political inertia. The industry successfully lobbied for minimum coverage standards that inflate administrative costs, while simultaneously enjoying government incentives (like the Medicare Levy Surcharge) that force middle and high-income earners into their products. This creates an artificially captive market.

The system relies on the healthy subsidizing the sick, which is standard insurance practice. However, the current model allows insurers to maintain high profit margins by aggressively cutting payouts on common procedures and increasing excesses. When a GP slams the sector, they are pointing out the obvious: the middle-class safety net is being deliberately frayed. This erodes public trust in Australian healthcare, pushing more people toward the already overburdened public system. This isn't just bad business; it's a transfer of risk from well-funded corporations to the individual taxpayer.

Furthermore, the complexity of policies—the labyrinthine tiers of Bronze, Silver, and Gold—is a deliberate obfuscation tactic. It makes direct comparison impossible, stifling genuine competition. It’s designed to make consumers feel they are making an informed choice when, in reality, they are just picking the least offensive form of financial exposure. This is the hidden agenda: maintain market share through confusion.

The Prediction: Where Do We Go From Here?

The current trajectory is unsustainable. We predict that within three years, a major regulatory shake-up will be forced, not by consumer outrage, but by insolvency fears among smaller players or a massive exodus from the market, further stressing public hospitals. The bold prediction is this: The government will be forced to introduce a 'Guaranteed Minimum Benefit' scheme, effectively nationalizing the core risk pool while allowing private insurers to manage administration—a move that will look like reform but will solidify the existing power brokers who can afford the compliance costs. Genuine competition will die, replaced by oligopoly management.

For those seeking genuine health insurance alternatives, the only viable path forward involves radical transparency, which the industry actively resists. Until then, every premium increase is less about covering rising medical costs and more about covering corporate overheads.

Frequently Asked Questions

What is regulatory capture in the context of private health insurance?

Regulatory capture occurs when a regulatory agency, created to act in the public interest, instead advances the commercial or political concerns of the special interest groups (like large insurers) that dominate the industry it is charged with regulating.

Are private health insurance premiums tax-deductible in Australia?

Premiums are not generally tax-deductible. However, high-income earners who do not hold adequate private hospital cover may have to pay the Medicare Levy Surcharge (MLS), which effectively penalizes them for not buying private insurance.

What is the main reason GPs are criticizing the private health sector?

GPs criticize the sector primarily because rising premiums and restrictive policies are leading to lower rebates and reduced patient access to necessary services, increasing the gap between medical costs and what insurance covers.

How does the 'pay more, get less' trend affect public hospitals?

When private cover becomes too expensive or restrictive, consumers drop out or downgrade, forcing them into the public system for non-emergency procedures, thereby increasing waiting lists and straining public hospital resources.

Related News

The Hidden Cost Crisis: Why Your Health Insurance Is an Illusion of Security

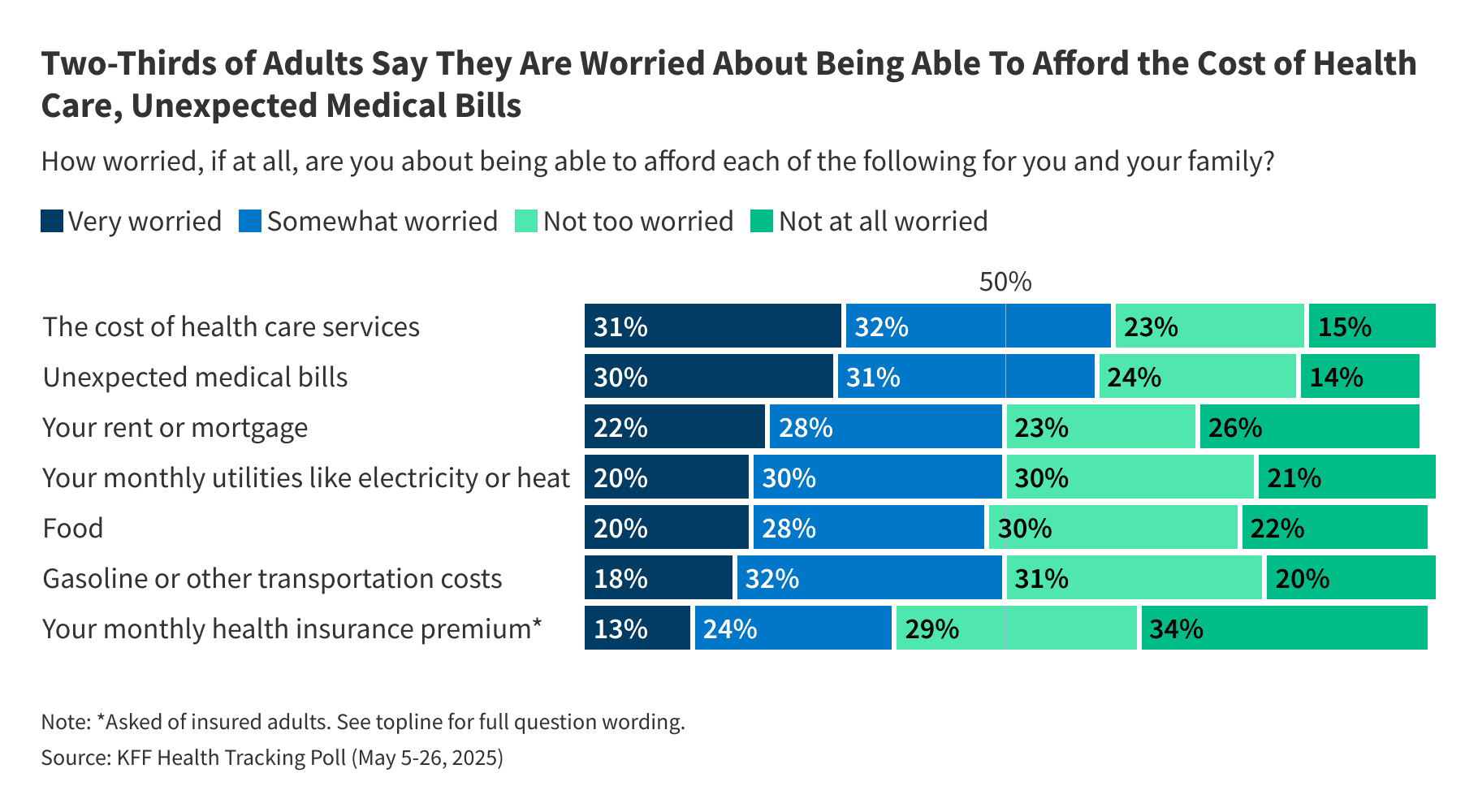

Forget premiums. The real American healthcare crisis isn't about access; it's about the crushing weight of **medical debt** and the illusion of coverage.

Veganuary 2026: The Hidden Corporate Power Grab Behind Your 'Healthy' Resolutions

Forget the health fad. The real story behind the booming Veganuary movement isn't your wellness; it's the seismic shift in food industry profits and manufactured guilt.

The 7-Hour Lie: Why Big Business Needs You to Be Sleep Deprived (And How It's Costing You Years)

The new science on chronic sleep deprivation isn't just a health warning—it's an economic blueprint. Discover the hidden costs of the 6-hour grind.