The Hidden Cost Crisis: Why Your Health Insurance Is an Illusion of Security

Forget premiums. The real American healthcare crisis isn't about access; it's about the crushing weight of **medical debt** and the illusion of coverage.

Key Takeaways

- •The focus on premiums obscures the real threat: deductibles and surprise bills causing mass medical debt.

- •Insurers profit from patients avoiding necessary care due to high out-of-pocket costs.

- •The system incentivizes a massive, inefficient administrative industry over patient wellness.

- •The future points toward a severe two-tier system unless debt collection laws are reformed.

The Hook: The Premium Lie and the Shadow Tax

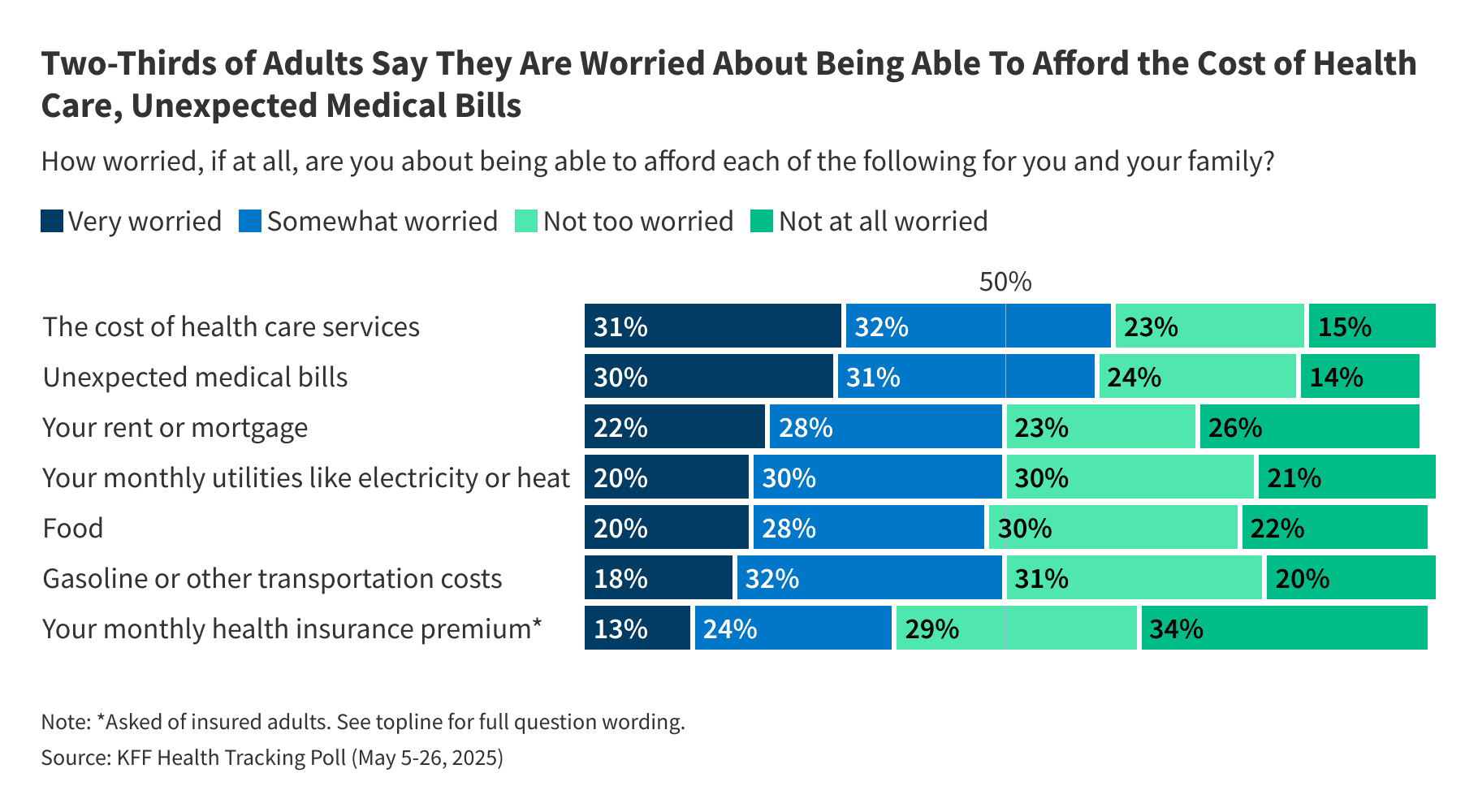

Everyone is talking about healthcare costs. KFF data confirms what we already feel in our wallets: Americans are terrified of the bill. Two-thirds worry about affording care. But this narrative is too simple. It’s a distraction. The true crisis isn't the monthly premium you pay; it's the catastrophic, debt-inducing shock of the deductible, the co-pay, and the out-of-network charge. This is the shadow tax on American life, and it’s destroying middle-class stability.

The Meat: Analysis of Managed Anxiety

Why are Americans so worried about affordability? Because the system is structurally designed to transfer risk directly onto the patient the moment they get sick. Insurance companies have mastered the art of 'managed anxiety.' They offer plans with low apparent premiums to look competitive, locking consumers into high-deductible health plans (HDHPs). This isn't about better health outcomes; it’s about shifting the burden of immediate liquidity onto the consumer.

The unspoken truth? The insurance industry wins when you avoid care. Every preventative screening you skip, every specialist referral you ignore because of the $4,000 deductible looming over you, is a direct saving for the insurer. We are paying for security that we are financially penalized for actually using. This perverse incentive structure means the system prioritizes actuarial tables over public health.

The Deep Dive: Who Really Loses in the Cost War?

The losers are clear: the chronically ill and the 'just-getting-by' middle class. Those with chronic conditions are trapped in an endless cycle of high co-pays, while those who are relatively healthy use their insurance only as a catastrophic fire extinguisher. The real engine of medical debt—the silent epidemic—is the surprise bill and the high out-of-pocket maximum. People are not afraid of getting sick; they are afraid of the resulting bankruptcy filing. This fear chills innovation and entrepreneurship, as starting a business becomes synonymous with gambling your family’s financial future on a single ER visit.

Consider the administrative bloat. The complexity of navigating in-network vs. out-of-network providers, prior authorizations, and coding disputes consumes billions. This isn't healthcare; it's a massive, highly profitable administrative industry built atop the foundation of human frailty. For deeper context on the economic drivers, look at how pharmaceutical pricing intersects with this model (see reports from major economic journals like the Brookings Institution).

What Happens Next? The Prediction

The current trajectory is unsustainable. We will not see comprehensive single-payer reform anytime soon. Instead, expect a bifurcated system to solidify. On one side, the hyper-wealthy will increasingly opt for direct primary care models or concierge medicine, paying cash upfront for predictable costs and eliminating the insurance headache entirely. On the other, the masses will be pushed further into government-subsidized, high-deductible plans that function more like catastrophic savings accounts than true insurance.

My bold prediction: The next major political flashpoint won't be prescription drug prices, but the bankruptcy courts' rising caseloads from medical insolvency. Lawmakers will be forced to address the debt crisis directly, perhaps through federal limits on medical collections, rather than fixing the underlying cost structure. We will treat the symptom—the debt—while the disease—the cost—rages on.

Gallery

Frequently Asked Questions

What is the difference between a deductible and an out-of-pocket maximum?

The deductible is the amount you must pay entirely before your insurance company starts sharing costs. The out-of-pocket maximum is the absolute cap on what you will pay in a plan year (including deductibles and co-pays); once you hit it, the insurer pays 100% of covered services.

Why are so many Americans worried about healthcare costs even with insurance?

Worry stems from the high deductibles and co-insurance required before coverage kicks in, the risk of 'surprise billing' from out-of-network providers during in-network procedures, and the fear that a major illness will deplete savings or lead to medical debt.

What are 'surprise medical bills'?

Surprise medical bills occur when a patient receives care at an in-network facility (like an emergency room) but one of the treating physicians (like the anesthesiologist or radiologist) is unexpectedly out-of-network, leading to a much higher, unexpected bill.

How does medical debt affect the US economy?

Medical debt is a leading cause of personal bankruptcy in the U.S. It damages credit scores, prevents families from securing mortgages or loans, and depresses consumer spending, acting as a significant drag on local and national economic activity.

Related News

Veganuary 2026: The Hidden Corporate Power Grab Behind Your 'Healthy' Resolutions

Forget the health fad. The real story behind the booming Veganuary movement isn't your wellness; it's the seismic shift in food industry profits and manufactured guilt.

The 7-Hour Lie: Why Big Business Needs You to Be Sleep Deprived (And How It's Costing You Years)

The new science on chronic sleep deprivation isn't just a health warning—it's an economic blueprint. Discover the hidden costs of the 6-hour grind.

The $193 Million Illusion: Who REALLY Benefits From Shapiro's Healthcare Windfall?

Shapiro's $193 Million federal healthcare funding win isn't just good news; it’s a political chess move masking deeper systemic funding instability in state health services.