The Silent Coup: Why Hillcrest's 'Success' with a Tier 1 Supplier Hides a Brutal Automotive Reality

Hillcrest's recent tech evaluation victory is less about innovation and more about the ruthless consolidation happening in automotive technology supply chains. Unpacking the hidden costs.

Key Takeaways

- •The Tier 1 supplier likely gained significant R&D insights during the 'evaluation' process.

- •This partnership signals market validation but risks severe margin compression for Hillcrest.

- •The underlying trend is the consolidation of innovation within large automotive incumbents.

- •A future fire sale acquisition or stagnation for Hillcrest is a highly probable outcome.

The Hook: Are We Mistaking Validation for Victory?

The press release smelled like victory: Hillcrest successfully completes technology evaluation with a 'Global Tier 1 Automotive Supplier.' On the surface, this signals validation, market entry, and a bright future for Hillcrest's proprietary tech. But in the high-stakes, razor-thin margin world of automotive technology, this announcement is less a triumph and more a signal flare in a crowded, sinking lifeboat. Who truly benefits when a small player gets 'approved' by a giant? Hint: It’s rarely the small player.

The 'Meat': Deciphering the Tier 1 Game

Let’s cut through the corporate jargon. A 'Tier 1' supplier isn't just a customer; they are a gatekeeper to the entire OEM (Original Equipment Manufacturer) ecosystem. Securing an evaluation means Hillcrest’s technology integration has passed the initial sniff test. But passing a test is not winning the war. Tier 1s are notorious for two things: extracting maximum value and crushing competition once a technology is proven viable.

The unspoken truth here is leverage. The Tier 1 supplier has likely spent months, if not years, reverse-engineering the core concept during this 'evaluation.' They needed Hillcrest to solve the hardest R&D problems, effectively outsourcing their innovation risk. Now that the proof-of-concept is solid, the Tier 1 can dictate terms—pricing, volume, exclusivity—that will squeeze Hillcrest’s margins until they are barely profitable, or risk being sidelined entirely.

The Why It Matters: The Death of Independent Innovation

This story isn't about Hillcrest; it's about the systemic pressure crushing independent technology firms in the auto sector. As the industry pivots rapidly toward electrification and autonomy (see the massive shifts documented by groups like the International Organization of Motor Vehicle Manufacturers), established giants are panicked. They can’t innovate fast enough internally. Their strategy? Acquire the IP cheaply or strangle the innovator slowly through contractual obligations.

This dynamic creates a perverse incentive structure. Startups race not to build sustainable businesses, but to be acquired before they are crushed. The real winner here is the Tier 1, which gains cutting-edge capability without the messy, expensive internal disruption. They absorb the risk, internalize the tech, and maintain market dominance. This is the consolidation play of the decade, disguised as a partnership announcement.

Where Do We Go From Here? The Prediction

Expect silence, followed by a lukewarm contract announcement in 12-18 months. Hillcrest will secure a small, pilot program order, enough to satisfy investors but not enough to scale rapidly. The Tier 1 will drag out integration, using Hillcrest’s resources for final debugging while simultaneously shopping a competing, cheaper, internally developed alternative based on the now-proven architecture. Prediction: Within three years, Hillcrest will either be forced into a fire sale acquisition at a fraction of its potential value or be relegated to a niche, non-core supplier status, having ceded control of its core intellectual property. The future of automotive technology depends on resisting this gravitational pull toward absorption.

Gallery

Frequently Asked Questions

What is the primary risk for Hillcrest after this technology evaluation?

The primary risk is losing pricing power and intellectual property leverage to the Tier 1 supplier, who can now dictate unfavorable terms or develop internal competition based on the proven technology.

What defines a 'Global Tier 1 Automotive Supplier'?

A Tier 1 supplier directly provides complete systems or components to the final vehicle manufacturer (OEM), such as Bosch, Continental, or Magna, holding significant control over the automotive supply chain.

How does this impact electric vehicle (EV) development?

It shows that even in rapidly evolving sectors like EV technology, large established players still control the pathways for new innovations to reach mass production, often stifling smaller, disruptive entities.

Related News

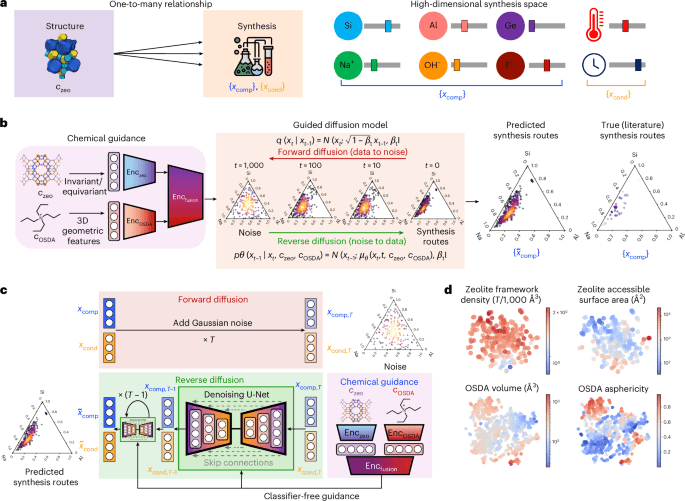

The AI Alchemy Revolution: Why DiffSyn Isn't Just New Science, It's a Threat to Traditional Chemistry Careers

Generative AI like DiffSyn is fundamentally reshaping materials science. Discover the unspoken winners and losers in this new era of chemical discovery.

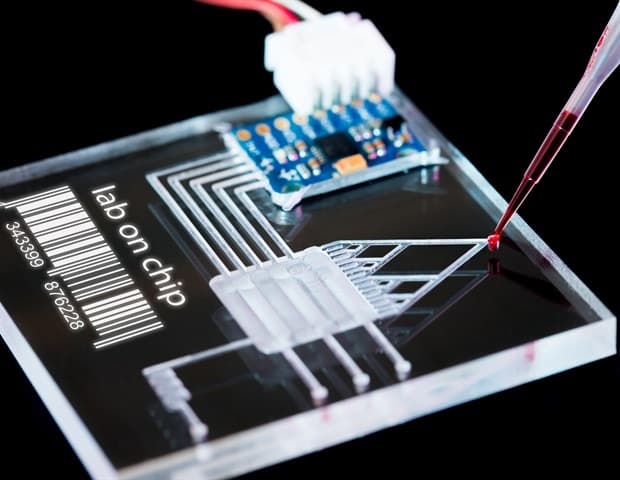

The Hidden Cost of Lab-Grown Organs: Why Simplified Microfluidics Will Bankrupt Traditional Biotech

Digital microfluidic technology is changing 3D cell culture, but the real story is the centralization of pharmaceutical power it enables.

The Hidden Cost of 'AI Saviors': Why Ravender Pal Singh's Math Background Exposes Silicon Valley's Shallow Hype Cycle

The journey from pure mathematics to AI innovation isn't just career progression; it's a warning about AI safety. Unpacking the real stakes.

DailyWorld Editorial

AI-Assisted, Human-Reviewed

Reviewed By

DailyWorld Editorial